Integrate Payroll System with Microsoft Dynamics 365: A Smooth and Efficient Process

Integrating an efficient and reliable payroll system has become an important practice for growing businesses. It supports them to deal with evolving tax compliances and implementing different labour laws.

However, payroll systems become standard in most ERP (enterprise resource planning) solutions, but dealing with the complicated processes of the HR department requires a powerful and adaptable payroll solution.

The standard payroll features work perfectly fine unless the business starts to scale and cater its products and services to global clients. In such a scalability scenario, managing global payroll demands becomes an absolute nuisance for businesses.

No doubt, Microsoft Dynamics 365 offers powerful ERP solutions for diverse industries and does come with all the required payroll capabilities under the HR module, but diversifying businesses cannot rely on a single solution to perform all operations. Businesses need to integrate other solutions with advanced capabilities capable of simplifying the specific business needs.

This leads the solutions of the Microsoft Dynamics 365 ecosystem to integrate with other add-ons or third-party solutions to establish a data flow while powering up the entire system. In general, there are three integration methods available that you can follow to connect two systems together. Before moving to integration methods, let’s understand the payroll system and its need for modern businesses.

What is a Payroll System?

A payroll system is a part of the HR department, which is a comprehensive application to manage all payroll activities of a business that includes disbursements of wages, viewing earnings statements, and managing tax documents. Also, payroll manages employee pay profiles, tracks deductions, calculates bonuses, and maintains benefits contributions. Some of the common tasks of payroll management are:

Calculating Wages

Calculate the wages of all employees, whether they work on an hourly, monthly, or commission basis, based on the compensation structure.

Deductions

Calculate taxes, track social security contributions, insurance premiums, and other deductions.

Tracking Attendance

Track the work hours of all employees, whether they are working in-office, remotely, or in hybrid locations.

Payment Distributions

Distribute salaries or payments through direct transfer, checks, or other methods while tracking all transactions with bank reconciliation.

Adhere to Compliances

Adapt to the changing tax compliances, evolving laws, labour regulations, and other legal rules.

Recordkeeping

Maintain all track records of financial transactions under payroll management while being global compliance friendly.

What is Microsoft Dynamics 365?

Microsoft Dynamics 365 is a suite of intelligent ERP and CRM solutions capable of streamlining diverse operations, enhancing operational efficiency, and offering the optimum level of customer experiences. Based on your business needs, you can go with any of the solutions that fit your business needs so that you can eliminate the redundancies and accelerate the growth path.

This suite includes solutions to streamline sales, finance, marketing, HR, supply chain, customer service, field service, and more. Being a set of cloud-based solutions, Microsoft Dynamics 365 leverages the power of AI and BI to provide automation, centralised communication, and real-time access to the data.

Some of the Microsoft ERP solutions that come with embedded payroll systems are:

- Microsoft Business Central

- Dynamics 365 F&O

- Dynamics 365 Finance

- Dynamics 365 Supply Chain Management

- Dynamics 365 Human Resources

What is the need for integrating a payroll system with Microsoft Dynamics 365?

For businesses that are scaling their operations to global boundaries, it is highly recommended to integrate any third-party advanced payroll system. However, choosing the right system totally depends on the unique business needs. But you can still go for a solution that offers scalability and flexibility to a greater extent to embrace the growing business needs. The integration of these systems brings you:

Data Consistency

The integration of the payroll system with Microsoft Dynamics 365 provides consistent data across the HR, finance, and accounting departments. It will ensure smooth data flow, accurate insights, and data consistency across different departments.

Enhanced Efficiency

Microsoft comes with built-in AI assistance, Microsoft Copilot, that empowers businesses to utilise automation and enhance overall efficiency. It enables you to automate data processes, eliminate recurring tasks, and reduce manual efforts,

Manages Compliance

Manage and track all compliances to streamline core tax processes that include tax calculations and financial reporting as per labour laws.

Comprehensive Insights

Get a holistic view of complete financial transactions along with workforce movements, performance, and workloads.

Major Integration Methods

In general, there are two primary integration methods available for all businesses:

Built-in Payroll system

Most of the ERP solutions come in-built with payroll systems that seem to be sufficient for businesses to deal with standard requirements. Such a system offers seamless data flow and great functionality within the ERP environment.

Third-party Integration

Some ERP doesn’t come up with integrated payroll systems, and businesses need to integrate specialised payroll systems to get things done. The connection generally occurs using the three below methods:

- API Integration: Connect two systems directly using APIs.

- File-Based Integration: Exporting data from one system to importing it to another.

- Middleware Integration: Requires third-party solutions to establish connection.

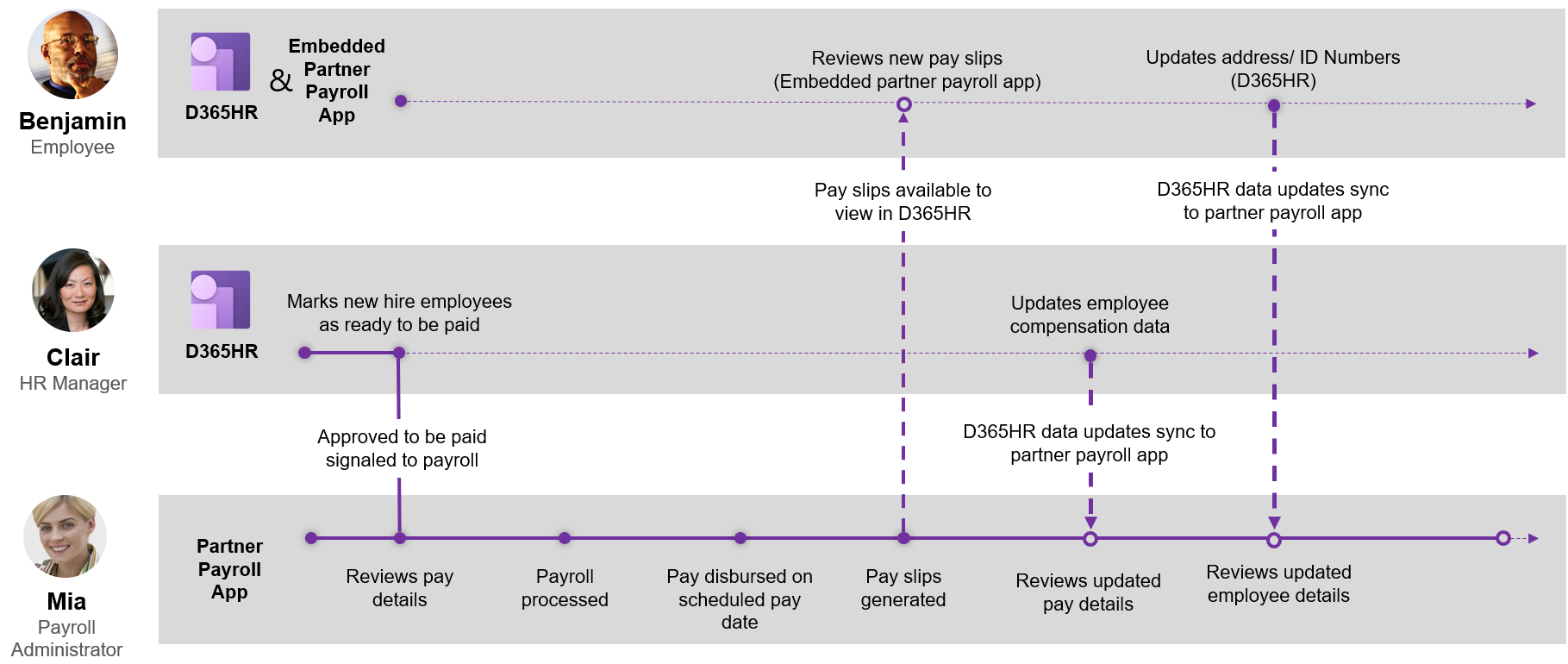

Integrating a Third-Party Payroll System with Microsoft Dynamics 365

The process of integrating a payroll solution with an ERP system directly depends on the method you have chosen to integrate. With the Dynamics 365 suite of cloud solutions, you can easily go with the API method.

- Choose a payroll system and purchase its licensing as per your requirements.

- Now, open the Microsoft Store in your Dynamics 365 solutions and search for the payroll system using addons and integrations.

- Once you find it, select the solution and enter the API that you can get from your payroll system.

- Now, open the payroll system and establish connection to build a bidirectional data link between the payroll system and Dynamics 365 ERP.

- After successful connection, you can easily manage HR data, run payroll operations, transmit data, and process payroll operations directly from Dynamics 365.

Can we use any payroll connector for the integration?

Establishing connections using a payroll connector is way simpler when compared to establishing connections using APIs. In this, you need to look for a payroll connector, feed the data of your payroll system and Microsoft Dynamics 365 solution, and you are good to go.

Isn’t this simple?

How can Dynamics Square help you with payroll integration?

The process to connect two systems to establish a bridge of sustainable financial data flow is simple and can require a little technical expertise for successful integration. However, no one is prepared for capricious risk that can fail the integration.

If you are unable to integrate the purchased payroll system with your Dynamics 365 solution or facing any complex scenario, feel free to reach out to the team at Dynamics Square. Regardless of the issue, we are a team of 150+ technical consultants available by your side with an effective and lasting solution.

Whenever you need us. Feel free to write us an email at info@dynamicssquare.co.uk or call us directly at +442035141057 for instant support.