Financial Consolidation in Dynamics 365 Finance

Performing financial consolidation in Dynamics 365 Finance enables the parent organisation to maintain good financial health across all subsidiary organisations. Regardless of international currency, you can easily consolidate financial transactions along with generating a real-time report for actionable decision-making. However, before learning the core benefits and capabilities of online financial consolidation in D365 Finance, let’s learn the basic concepts.

What is Financial Consolidation?

We know that streamlining and managing financial transactions for a business is a complicated process that must be executed with precision. One such process is financial consolidation, where large organisations have to merge the financial statements of many entities or subsidiaries to create a centralised financial report.

Such data is basically generated for higher management and stakeholders who want to get 360-degree financial visibility across all entities and control the business based on real-time data.

Financial consolidation reporting empowers the investors and management to improve the overall financial health rather than analysing the financial reports of each company. Most of the businesses perform such financial operations separately based on the entity and later centralise the data to get a holistic financial view of multi-location entities.

It is a manual process, and businesses perform this using spreadsheets, resulting in manual errors and resistance to getting accurate financial health. Such processes are simple as well as low-cost and require almost no training for the team to learn. However, it can be full of errors, expensive, and prone to duplicate data while providing almost no transparency.

This leads businesses to go for advanced financial management solutions that can simplify complex financial processes while giving a boost to financial health.

Introduction Microsoft Dynamics 365 for financial consolidation is capable of consolidating trial balance data of different subsidiaries while creating error-free financial reports. Such financial reports include balance sheets, cash flow, income statements, and financial reconciliation while following global tax norms or compliances. Even D365 F&O performs inter-company translations, ownership considerations, and manages cross-currency transactions.

Financial Consolidation in Dynamics 365 Finance

Dynamics 365 Finance is a powerful solution capable of managing complex financial operations of businesses without any hassle. It can seamlessly consolidate the financial data of different entities into a single unified financial statement, whether it is fully owned or not, irrespective of currencies.

The financial consolidation process starts when you declare all subsidiaries as legal entities. After this, the entire financial data of subsidiary companies in different currencies will be transferred to the parent company with the defined currency for consolidation processing.

However, you can’t post, track, or edit a daily journal in a consolidation company, but you can do the same in an elimination company. So, you might need a specific elimination company for daily journals.

Because the main purpose of the consolation company is to provide a consolidated view of the group's financial information, allowing direct posting, tracking, and editing of journal entries could lead to inconsistencies and errors. But, in an elimination company, you can perform these actions because its specific purpose is to eliminate intercompany transactions. This flexibility allows you to adjust and correct as needed to ensure accurate elimination entries.

Performing Financial Consolidation in Dynamics 365 F&O

Performing financial consolidation in Dynamics 365 F&O is simple, as this solution is equipped with all advanced tools and functionalities for an error-free consolidation. Before you run the precise consolidation, you need to follow the below pre-requisite.

- From the administration menu, create a new consolidation legal entity.

- Search for Consolidation Company and select yes of Use for Financial Consolidation and User for Elimination Process.

- Set up theLedger and Journal for the Consolidation Company with the name of your choice.

Set-up Automatic Transactions

- Go to Posting Setup from General Ledger and search for Automatic Transactions, where you need to specify two posting account types.

- First is setting up a balance account for consolidation differences.

- Another profit and loss account to settle consolidation differences

Setting Up Ledger Balances

- Select Ledger button to specify accounts. You find this Ledger Setup under the General Ledger button.

- Find the Accounts for Reconciliation Tab and specify the main accounts to record unrealised gains and losses.

- Now, go to Account for Automatic Transactions and select Balance Sheet Account for Consolidation Differences.

Setting Up Exchange Rate

- Now, you need to set up exchange rate for consolidation and currency adjustment.

- To do so, go to Currency Exchange Rate under Currencies, followed by general Leder.

- In designated places, fill in the exchange rate pairs.

Till now, we have executed all the necessary steps required to run a successful financial consolidation. Now, it’s time to run the same.

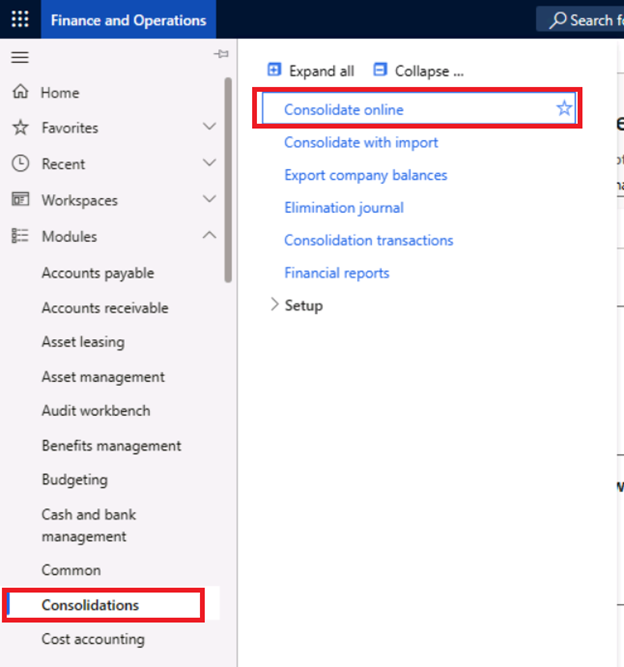

Perform Online Consolidation

The process to perform online consolidation is way easier as compared to the manual process that includes spreadsheets. The step-by-step process is given next:

- Click on Consolidate Online from the Consolidations menu and specify the duration for consolidation.

- Now, you need to specify the range of accounts for consolidation. However, this is an optional feature, and we suggest you keep it empty.

- Set the Use Consolidation Account option to yes or no as per your requirements. If you select yes, you need to further specify whether the consolidation account must be selected from the main account, or it is from a group of accounts.

- Set the option Yes to Include Actual Amounts. Also, you need to specify whether you want to include the budget amount in the consolidation or not. So, choose the options wisely.

- After all such steps, you are good to go to run online financial consolidation with Dynamics 365 Finance and Operations.

How can Dynamics Square help you Streamlining Financial Consolidation?

Performing streamlined and smooth financial consolidation is a critical process, and it doesn’t have any scope for human errors or uncertainty. In such an important task, we need accuracy and precision for enhanced performance.

If you want to eliminate all chances of errors while streamlining the complete financial consolidation process, Dynamics Square can help you with this. With 14+ years of experience and a team of expert financial consultants, we can eliminate system redundancies and automate the core processes for better efficiency.

Regardless of complex financial operations, we can simplify them by leveraging innovation and technology. So, whenever you need us, feel free to write us an email at info@dynamicssquare.co.uk or call us directly at +44 203 514 1057 for instant support.